Table of Contents

An nft marketplace development guide is increasingly relevant as NFTs move beyond hype-driven collectibles into real digital ownership and business use cases. According to Fortune Business Insights, the global NFT market reached USD 26.9 billion in 2023 and is projected to grow at a CAGR of over 34%, driven by gaming, media, brand engagement, and utility-based applications. This growth is pushing more companies to explore NFT marketplaces as long-term platforms rather than short-term experiments.

From our experience working on NFT marketplace projects, the challenge today is no longer whether NFTs work—but how to build marketplaces that are secure, scalable, and usable beyond crypto-native audiences. This guide breaks down NFT marketplace development from a practical, product-first perspective, covering architecture, features, development process, challenges, and future trends—so teams can make informed decisions before building.

What is an NFT marketplace?

An NFT marketplace is a digital platform where users can mint, buy, sell, and trade non-fungible tokens (NFTs) securely on a blockchain. From our experience building and supporting NFT products, the marketplace is not just a storefront—it’s the full transaction engine that handles ownership verification, smart contract execution, payments, royalties, and user trust.

In real projects, an NFT marketplace typically combines several layers: a blockchain network (like Ethereum or a compatible Layer 2), smart contracts that define ownership and royalties, a backend that manages metadata and indexing, and a frontend where users discover and trade assets. We’ve seen teams underestimate this complexity early on—thinking it’s “just minting and listing”—but the real work is in making the experience reliable, scalable, and compliant as volume grows. When done right, an NFT marketplace becomes a programmable business model, not just a trading site.

Types of NFT Marketplaces: NFT Use Cases in Practice

From our experience building and reviewing NFT marketplace projects, the biggest mistake teams make is treating all NFT marketplaces as the same. In reality, the use case defines everything—from smart contract design to UX, scalability, and even legal considerations. Below are the most common NFT marketplace types we see in real projects, explained through how they’re actually used.

Art & Digital Collectibles Marketplaces

This is the most familiar NFT use case and often where teams start. These marketplaces focus on creators minting digital artwork or collectibles and selling them directly to buyers or through auctions. From our side, the real challenge here isn’t minting—it’s handling creator royalties, preventing plagiarism, and supporting discovery at scale. Marketplaces that succeed usually invest heavily in curation, creator onboarding, and smooth wallet interactions.

Gaming & Metaverse NFT Marketplaces

In gaming-focused NFT marketplaces, NFTs represent in-game assets such as characters, skins, weapons, or virtual land. We’ve worked on projects where NFTs weren’t just tradable items but core parts of gameplay and progression. These marketplaces need tight integration with game logic, real-time data updates, and low transaction costs. If the marketplace feels slow or disconnected from the game, players lose trust fast.

Music, Media & Creator Economy Marketplaces

These marketplaces allow musicians, filmmakers, and content creators to tokenize songs, albums, videos, or access rights. In practice, this use case shifts the focus from speculation to fan engagement and monetization. From experience, the hard part is managing licensing terms, royalty splits, and long-term access—not the NFT itself. UX clarity is critical so buyers understand what they actually own.

Utility & Membership NFT Marketplaces

Utility-based NFT marketplaces trade NFTs that unlock real benefits—membership access, event tickets, discounts, or gated content. We’ve seen this work especially well for brands and communities. The marketplace must integrate with off-chain systems like access control, CRM, or ticketing platforms. The value lives outside the NFT, so syncing on-chain ownership with real-world perks is the tricky part.

Enterprise & Asset Tokenization Marketplaces

Some NFT marketplaces are built for enterprises, not the public. These tokenize assets like documents, certificates, intellectual property, or supply-chain records. In these projects, compliance, permissioned access, and auditability matter far more than flashy UI. From experience, these marketplaces behave more like secure platforms than open crypto products—and they’re often overlooked despite having strong business value.

Sports & Fan Engagement

Sports NFT marketplaces focus on moments, collectibles, or fan experiences tied to teams and athletes. What we’ve learned here is that success depends on emotional engagement, not trading volume alone. Features like limited drops, live-event integration, and social sharing usually matter more than advanced trading mechanics.

Real-World Asset (RWA) NFT Marketplaces

These marketplaces tokenize physical assets such as real estate shares, luxury goods, or certificates of authenticity. From a development perspective, this is one of the most complex use cases. The marketplace must bridge on-chain ownership with off-chain legal agreements, custody, and verification. When done right, it opens serious business opportunities—but it’s definitely not plug-and-play.

Every NFT marketplace starts with a use case, not a blockchain. Teams that design around real user value—art, gaming, access, or enterprise workflows—build platforms that last. Teams that chase trends usually struggle once the hype fades.

How an NFT Marketplace Works

From our experience building NFT marketplaces, most people think the magic happens on the blockchain—but in reality, it’s the coordination between on-chain and off-chain systems that makes a marketplace actually work. A good NFT marketplace feels simple to users, but under the hood, several components work together to ensure ownership, security, performance, and a smooth trading experience.

Components and Architecture of an NFT Marketplace

At a high level, an NFT marketplace is a layered system. Each layer has a clear responsibility, and problems usually arise when teams blur these boundaries or underestimate one of them.

- Blockchain layer (smart contracts)

This is the trust layer. Smart contracts handle NFT minting, ownership transfer, royalties, and transaction rules. From experience, getting this layer right is critical because mistakes are expensive to fix once deployed. Well-designed contracts are modular, upgrade-aware, and optimized for gas costs, especially if the marketplace expects volume.

- Storage layer (metadata & assets)

NFTs don’t usually store images or media directly on-chain. Instead, metadata and assets live on decentralized storage (like IPFS) or hybrid setups. We’ve seen teams cut corners here early, only to face broken NFTs later. A reliable storage strategy ensures NFTs remain accessible and verifiable long term.

- Backend services layer

This is where most marketplace logic lives. The backend indexes blockchain events, manages listings, tracks bids, calculates prices, and syncs on-chain data with off-chain systems. In practice, this layer is what keeps the UI fast and usable without forcing users to wait for blockchain confirmations all the time.

- Frontend (user interface)

The frontend is what users see, but it’s also where many NFT marketplaces win or lose trust. Wallet connections, listing flows, bidding, and transaction feedback must be clear and forgiving. From experience, UX confusion causes more failed transactions than blockchain issues—no joke.

- Wallet & payment integration

Wallets connect users to the blockchain and authorize transactions. The marketplace needs to support common wallets and handle transaction states gracefully. For fiat on-ramps, additional payment layers are required, adding compliance and security considerations.

- Admin & monitoring tools

Behind every successful marketplace is a solid admin layer. This includes moderation tools, analytics, fraud detection, and system monitoring. We’ve learned the hard way that skipping this part early makes scaling painful later.

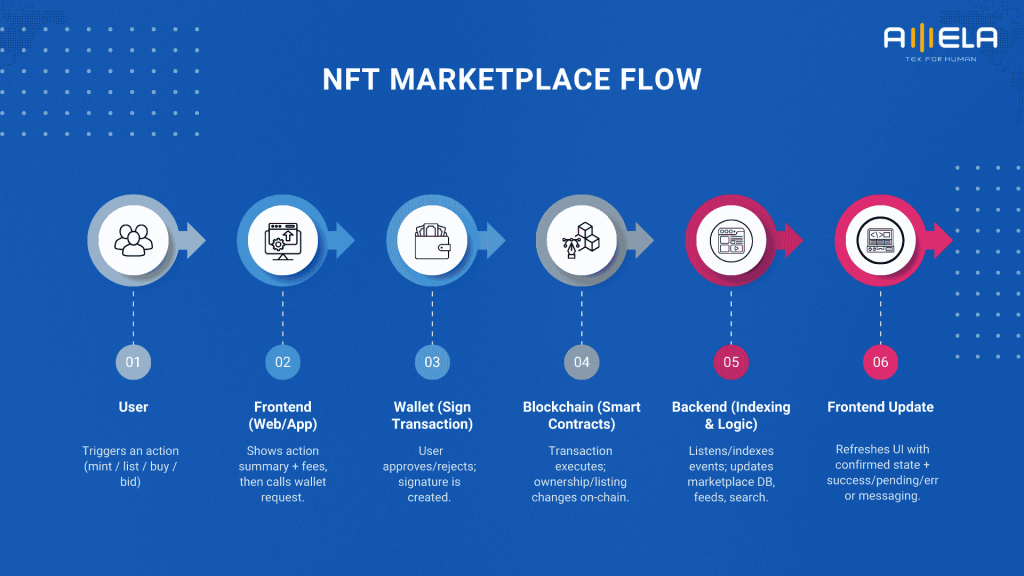

NFT Marketplace Flow

When a user lists or buys an NFT, the frontend triggers a wallet transaction, the smart contract executes ownership logic, the backend listens to that event, updates marketplace state, and reflects the result back to users in near real time. When this flow is designed cleanly, everything feels instant—even though blockchains aren’t.

NFT Marketplace Development Process

From our experience, NFT marketplace development only works when you treat it as a product journey—not a one-off blockchain build. Teams that rush straight into smart contract development usually hit UX, scalability, or trust issues later. Below is the process we follow in real projects, optimized to reduce risk and avoid rework.

1. Use Case & Business Model Definition

We always start by locking down the why before the how. This means clarifying the NFT use case (art, gaming, utility, enterprise), revenue model (fees, royalties, subscriptions), and target users. In practice, this step prevents overengineering and keeps the marketplace aligned with real value instead of hype.

2. Platform & Architecture Design

Next, we design the architecture across blockchain, backend, and frontend. This includes choosing the chain or Layer 2, defining smart contract boundaries, deciding how metadata is stored, and planning indexing and caching. From experience, good architecture decisions here save months later—no exaggeration.

3. Smart Contract Development & Review

Smart contracts are the trust layer, so we treat them carefully. We develop modular contracts for minting, listing, trading, and royalties, then review them thoroughly. Once deployed, changes are expensive, so this phase is all about precision and future-proofing.

4. Backend Development & Indexing

The backend turns raw blockchain data into a usable marketplace. We build services that listen to contract events, manage listings, track ownership, and support search and analytics. This layer is what makes the marketplace feel fast and reliable, even when the blockchain isn’t.

5. Frontend & Wallet Integration

Here’s where user trust is won or lost. We build clear flows for wallet connection, minting, buying, and selling, with strong feedback for pending and confirmed transactions. From experience, clean UX matters more than fancy features—users just want things to work.

6. Testing, Security & Performance Checks

Before launch, we test aggressively: smart contract behavior, edge cases, failed transactions, and load scenarios. Security reviews and testnet validation are non-negotiable. Skipping this step is how marketplaces end up in trouble—simple as that.

7. Launch, Monitoring & Iteration

Launch isn’t the finish line. After going live, we monitor transactions, user behavior, and system performance, then iterate quickly. The most successful NFT marketplaces treat post-launch feedback as part of development, not an afterthought.

The teams that succeed are the ones who respect the process. NFT marketplace development rewards discipline, clarity, and iteration – not shortcuts. When each phase is done right, everything downstream becomes smoother.

>>> Related: How to Build a Blockchain from Scratch

Key Features of an NFT Marketplace

From our experience building NFT marketplaces, features only matter if they support trust, usability, and scale. Teams often chase flashy ideas early, but the platforms that last focus on fundamentals first—then layer complexity once the core experience is solid. Below are the features we consistently prioritize in real-world projects.

User Profiles & Wallet-Based Identity

Instead of traditional accounts, NFT marketplaces rely on wallet addresses as user identity. A strong profile layer makes this feel human—showing owned NFTs, listings, transaction history, and activity. From experience, this transparency builds trust quickly, especially for new users.

NFT Minting & Asset Management

Minting is where creators enter the ecosystem. A good marketplace simplifies minting while still supporting metadata standards, royalties, and batch creation when needed. We’ve seen platforms struggle when minting flows are confusing—creators bounce fast if this step isn’t smooth.

Marketplace Listings & Trading Logic

Core trading features include fixed-price sales, auctions, and offers. These sound basic, but edge cases matter: canceled listings, expired auctions, partial fills, and failed transactions. Getting this logic right upfront saves a ton of pain later.

Royalty & Fee Management

Royalties are central to creator trust. Smart contracts must enforce royalty logic reliably, while the UI clearly explains how fees are split. From experience, unclear royalty handling causes more disputes than almost anything else.

Search, Filters & Discovery

As inventory grows, discovery becomes the real product. Filters by price, creator, rarity, traits, or collection are not “nice to have”—they’re essential. Marketplaces that invest here see better engagement and repeat usage.

Wallet & Payment Integration

Supporting popular wallets is table stakes. Many marketplaces also add fiat on-ramps to lower entry barriers. The key is handling wallet errors, network mismatches, and rejected transactions gracefully—this is where UX usually breaks.

Transaction Status & User Feedback

Blockchain transactions aren’t instant. Clear states—pending, confirmed, failed—keep users calm and informed. From experience, this feature alone reduces support tickets dramatically.

Admin & Moderation Tools

Every serious marketplace needs admin controls: content moderation, user management, suspicious activity monitoring, and analytics. Teams that skip this early regret it later—no exceptions.

Security & Access Controls

Security isn’t a feature users click, but it’s always felt. Contract permissions, admin roles, and protection against common attacks must be designed carefully. We’ve learned the hard way that retrofitting security is expensive and risky.

Analytics & Reporting

Analytics help operators understand volume, user behavior, and revenue trends. These insights guide feature decisions and marketplace growth. Without them, teams are basically flying blind.

From the field

The best NFT marketplaces don’t try to do everything at launch. They ship a reliable core—minting, trading, royalties, and UX clarity—then expand thoughtfully. That’s how platforms earn trust and scale without chaos.

Conclusion

A practical nft marketplace development guide should help teams think beyond minting and trading mechanics. From architecture and smart contracts to UX, security, and post-launch scalability, building an NFT marketplace is ultimately about designing a reliable product users can trust—not just deploying blockchain code. From our experience, the teams that succeed are those that start with a clear use case, validate early, and evolve their platforms step by step as the ecosystem matures.

If you’re exploring NFT marketplace development or planning to scale an existing platform, having the right technical foundation and delivery model makes a real difference. At AMELA, we support clients through end-to-end blockchain development services—from smart contracts and marketplace platforms to building dedicated teams that can grow with your product. Whether you need a full development partner or experienced blockchain developers to extend your team, the right setup early on helps reduce risk and accelerate outcomes.

FAQs About NFT Marketplace Development

Below are the questions we hear most often from founders, product owners, and business teams exploring NFT marketplace development. These answers are based on real delivery experience—not theory.

How much does NFT marketplace development cost?

The cost depends heavily on scope, blockchain choice, and feature depth. In practice, a basic NFT marketplace with core minting, trading, and wallet integration costs significantly less than a full-scale platform with advanced discovery, fiat payments, and enterprise-grade security. From experience, teams that start with a focused MVP and scale iteratively control cost far better than those trying to build everything upfront.

>>> Related: Blockchain Development Cost: A Comprehensive Guide

How long does it take to build an NFT marketplace?

Timelines vary, but most marketplaces take several months from concept to launch. Smart contract design, testing, and frontend UX usually consume the most time. Projects move faster when requirements are clear and architecture decisions are made early—rushing this stage almost always slows things down later.

What are the biggest challenges in NFT marketplace development?

The biggest challenges in blockchain are not technical alone. We consistently see teams struggle with UX clarity, transaction feedback, security assumptions, and scalability under real usage. Blockchain complexity amplifies small mistakes, so careful design and testing are critical.

Which blockchain is best for NFT marketplaces?

There’s no single “best” chain. Ethereum offers strong ecosystem support, while Layer 2 solutions reduce fees. Other chains may offer speed or cost advantages. The right choice depends on users, transaction volume, and long-term goals—not hype.

How do NFT marketplaces handle security risks?

Security starts with smart contract design and continues through backend access control, monitoring, and audits. From experience, marketplaces that invest early in security reviews and testing avoid costly incidents later. Cutting corners here is never worth it.

Can NFT marketplaces support fiat payments?

Yes, but fiat integration adds complexity. It requires third-party payment providers, compliance checks, and additional backend logic. Many teams start crypto-only and add fiat later once product-market fit is proven.

What trends will shape NFT marketplaces going forward?

We’re seeing strong momentum in utility NFTs, gaming integration, interoperability, and better UX for non-crypto users. Marketplaces that reduce friction and connect on-chain ownership with real-world value are leading the next phase.

Jan 16, 2026

Jan 16, 2026